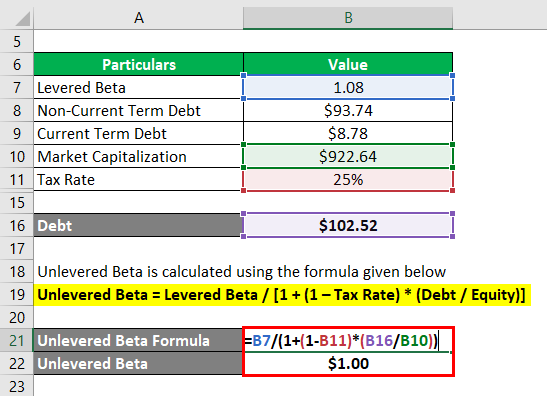

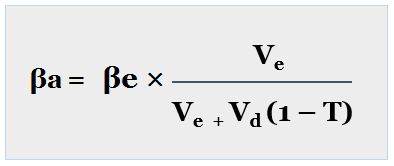

This can be calculated using the formula below:

The last step is to calculate the company's unlevered beta. We can calculate it using the formula below:ĭ/E ratio = total debt / total shareholders' equity Next, we need to calculate the company's debt-to-equity ratio, also known as the D/E ratio.

Determine the levered beta / equity beta.Total shareholders' equity: $6,000,000 andĬalculating the unlevered beta requires four steps:.Let's take Company Alpha as an example to help us understand the calculation of the unlevered beta.Ĭompany Alpha reports the following information:

0 kommentar(er)

0 kommentar(er)